Le boom économique d’Israël est en fait une bulle spéculative destinée à éclater, affirme mardi le prophète économique du magazine Forbes, Jesse Colombo, connu pour avoir prédit entre autre la crise financière mondiale.

Why Israel's Boom Is Actually A Bubble Destined To Pop

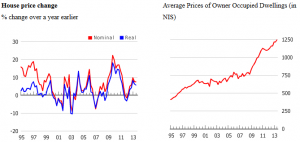

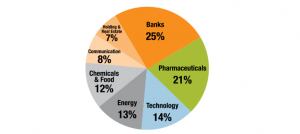

In the past few years, Israel’s economy has been praised for its stability and strong performance during and after the Global Financial Crisis. Israel’s booming tech industry has earned it the nickname “The Startup Nation” and international tech companies from Google to Facebook are clamoring to acquire the country’s startups. Investors the world over have been vying to add Israeli investments to their portfolios. Rather than experiencing a property slump like the U.S. and many countries did, Israel’s property prices are soaring and making speculators rich. Sadly, Israel’s economic boom is not the miracle that it appears to be, but is actually another bubble that is similar to those that caused the financial crisis.

Though it can be argued that Israel is no longer an emerging economy, Israel’s economic bubble has been following a similar pattern to the overall emerging markets bubble that I have been warning about. The emerging markets bubble began in 2009 after China embarked on an ambitious credit-driven, infrastructure-based growth plan to boost its economy during the Global Financial Crisis. China’s economy immediately rebounded due to the surge of construction activity, which drove a global raw materials boom that benefited commodities exporting countries such as Australia and emerging markets.

Emerging markets’ improving fortunes attracted the attention of international investors who were looking to diversify away from the heavily-indebted Western economies that were at the heart of the financial crisis. Eventually, even countries that were not significant commodities exporters (such as Israel) began to benefit from the growing interest in this investment theme.

Record low interest rates in the U.S., Europe, and Japan, along with the U.S. Federal Reserve’s multi-trillion dollar quantitative easing programs, caused $4 trillion of speculative “hot money” to flow into emerging market investments over the last several years. A global carry trade arose in which investors borrowed cheaply from the U.S. and Japan, invested the funds in high-yielding emerging market assets, and earned the interest rate differential or spread. Soaring demand for emerging market investments led to a bond bubble and ultra-low borrowing costs, which resulted in government-driven infrastructure booms, dangerously rapid credit growth, and property bubbles in countless developing nations across the globe.

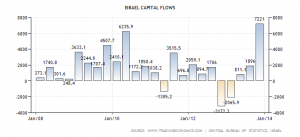

Capital inflows into Israel immediately increased after the financial crisis and hit a record high of $7.22 billion in the fourth quarter of 2013:

Source: Trading Economics

Strong capital inflows are the reason why Israel has been able to maintain a current account surplus despite the country’s growing trade deficit over the past decade.

Foreign “hot money” inflows into Israel contributed to a 23 percent increase in the shekel currency’s strength against the U.S. dollar since the financial crisis:

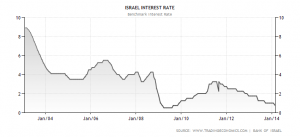

To stem Israel’s export-harming currency strength and support economic growth, the country’s benchmark interest rate, prime rate, and effective interbank rate were cut to all-time lows:

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

The global bond bubble and safe-haven demand helped to push 10 year Israel government bond yields down to a record low of just 3.34 percent after the financial crisis:

Source: Trading Economics

Exports account for approximately 40 percent of Israel’s GDP, which means that the country’s economy is adversely affected by appreciation of the shekel currency. For the past six years, Bank of Israel has been waging a war against the strong shekel – the world’s best performing major currency in 2013 – with a combination of ultra-low interest rates and aggressive currency interventions.

Since 2008, Bank of Israel has purchased over $50 billion worth of foreign currencies with newly created or “printed” shekels in an attempt to weaken the currency. As a result, Israel’s M1 money supply, which includes physical cash and demand deposits (typically checking accounts), surged by 150 percent even though the country’s real GDP grew by only 22 percent:

Source: Trading Economics

Suite: http://www.forbes.com/sites/jesseco...ls-boom-is-actually-a-bubble-destined-to-pop/

Why Israel's Boom Is Actually A Bubble Destined To Pop

In the past few years, Israel’s economy has been praised for its stability and strong performance during and after the Global Financial Crisis. Israel’s booming tech industry has earned it the nickname “The Startup Nation” and international tech companies from Google to Facebook are clamoring to acquire the country’s startups. Investors the world over have been vying to add Israeli investments to their portfolios. Rather than experiencing a property slump like the U.S. and many countries did, Israel’s property prices are soaring and making speculators rich. Sadly, Israel’s economic boom is not the miracle that it appears to be, but is actually another bubble that is similar to those that caused the financial crisis.

Though it can be argued that Israel is no longer an emerging economy, Israel’s economic bubble has been following a similar pattern to the overall emerging markets bubble that I have been warning about. The emerging markets bubble began in 2009 after China embarked on an ambitious credit-driven, infrastructure-based growth plan to boost its economy during the Global Financial Crisis. China’s economy immediately rebounded due to the surge of construction activity, which drove a global raw materials boom that benefited commodities exporting countries such as Australia and emerging markets.

Emerging markets’ improving fortunes attracted the attention of international investors who were looking to diversify away from the heavily-indebted Western economies that were at the heart of the financial crisis. Eventually, even countries that were not significant commodities exporters (such as Israel) began to benefit from the growing interest in this investment theme.

Record low interest rates in the U.S., Europe, and Japan, along with the U.S. Federal Reserve’s multi-trillion dollar quantitative easing programs, caused $4 trillion of speculative “hot money” to flow into emerging market investments over the last several years. A global carry trade arose in which investors borrowed cheaply from the U.S. and Japan, invested the funds in high-yielding emerging market assets, and earned the interest rate differential or spread. Soaring demand for emerging market investments led to a bond bubble and ultra-low borrowing costs, which resulted in government-driven infrastructure booms, dangerously rapid credit growth, and property bubbles in countless developing nations across the globe.

Capital inflows into Israel immediately increased after the financial crisis and hit a record high of $7.22 billion in the fourth quarter of 2013:

Source: Trading Economics

Strong capital inflows are the reason why Israel has been able to maintain a current account surplus despite the country’s growing trade deficit over the past decade.

Foreign “hot money” inflows into Israel contributed to a 23 percent increase in the shekel currency’s strength against the U.S. dollar since the financial crisis:

To stem Israel’s export-harming currency strength and support economic growth, the country’s benchmark interest rate, prime rate, and effective interbank rate were cut to all-time lows:

Source: Trading Economics

Source: Trading Economics

Source: Trading Economics

The global bond bubble and safe-haven demand helped to push 10 year Israel government bond yields down to a record low of just 3.34 percent after the financial crisis:

Source: Trading Economics

Exports account for approximately 40 percent of Israel’s GDP, which means that the country’s economy is adversely affected by appreciation of the shekel currency. For the past six years, Bank of Israel has been waging a war against the strong shekel – the world’s best performing major currency in 2013 – with a combination of ultra-low interest rates and aggressive currency interventions.

Since 2008, Bank of Israel has purchased over $50 billion worth of foreign currencies with newly created or “printed” shekels in an attempt to weaken the currency. As a result, Israel’s M1 money supply, which includes physical cash and demand deposits (typically checking accounts), surged by 150 percent even though the country’s real GDP grew by only 22 percent:

Source: Trading Economics

Suite: http://www.forbes.com/sites/jesseco...ls-boom-is-actually-a-bubble-destined-to-pop/

Pièces jointes

-

israel-capital-flows.png19.9 KB · Affichages: 8

israel-capital-flows.png19.9 KB · Affichages: 8 -

Shekel.png48.8 KB · Affichages: 8

Shekel.png48.8 KB · Affichages: 8 -

israel-interest-rate.png16 KB · Affichages: 8

israel-interest-rate.png16 KB · Affichages: 8 -

israel-bank-lending-rate.png13 KB · Affichages: 13

israel-bank-lending-rate.png13 KB · Affichages: 13 -

israel-interbank-rate.png13.8 KB · Affichages: 10

israel-interbank-rate.png13.8 KB · Affichages: 10 -

israel-government-bond-yield.png11.9 KB · Affichages: 8

israel-government-bond-yield.png11.9 KB · Affichages: 8 -

israel-money-supply-m1.png12.5 KB · Affichages: 8

israel-money-supply-m1.png12.5 KB · Affichages: 8 -

HousingBubble.png30.5 KB · Affichages: 8

HousingBubble.png30.5 KB · Affichages: 8 -

MortgageRates.png10.6 KB · Affichages: 8

MortgageRates.png10.6 KB · Affichages: 8 -

BankSector.png73 KB · Affichages: 8

BankSector.png73 KB · Affichages: 8